127

128

129

130

131

132

133

134

135

137

138

139

温铁军:80年代北朝鲜比中国发达,农业现代化、人均GDP比中国高。但快速城镇化使农业人口锐减,俄油断掉后农业断粮,饥荒衰退。

Wen Tiejun, renowned agri-economist: North Korea agri production/GDP per cap > China in 1980s; then Russia oil supply stopped — agri failed — tailspin.

140

141

142

143

144

145

146

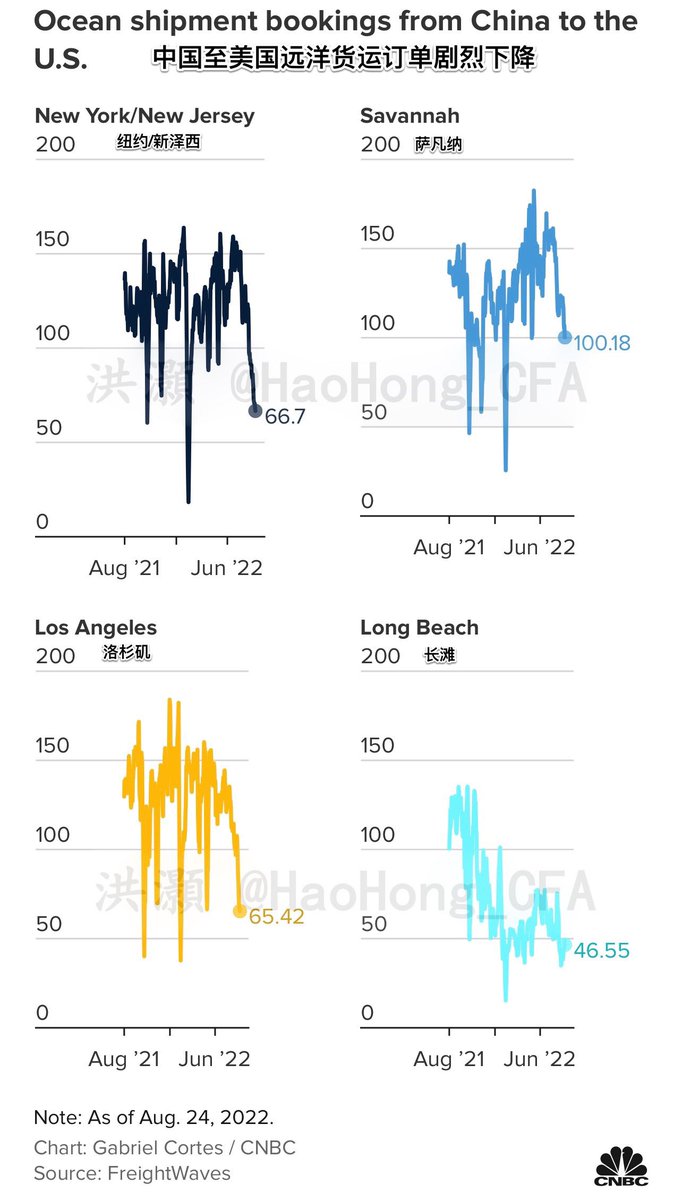

中国至美国海运订单剧烈下降;中国制造业订单下降20-30%;DHL称“不计成本发货的经济模式进入拐点”。

Shipping bookings from China to US way down; China manu order down 20-30%. DHL called “tipping point for the ship-at-all-cost economy”. (CNBC)

cnbc.com/2022/08/25/chi…

147

148

149

Investors in Evergrande wealth mgmt demanding repayment. An emergency meeting was hosted this weekend but no one’s willing to accept the proposal that basically attempted to delay payments. The Corp has 240bn in ST debt but only 86bn cash/quasi. Stock -7%.

150

1990, former president Jiang Zeming talked to ABC’s Barbara Walters on why China/US favorable trade agreement should continue. He ditched the interpreter half way. Great clip.