827

You have not been forgotten. We will not leave you behind. We are all in this together.

Information on all our business support schemes: businesssupport.gov.uk/coronavirus-bu…

828

7/ I know self-employed people are struggling right now, we’ve made sure:

- You can access the business interruption loans.

- Income tax payments due in July can be deferred to the end of Jan 2021.

- We’ve changed the welfare system so you can access Universal Credit in full.

829

8/ The scheme I have announced today is fair. It is targeted at those who need it the most and crucially, it is deliverable.

It provides an unprecedented level of support for self-employed people.

830

5/ 95% of people who are majority self-employed will benefit from this scheme.

HMRC are working urgently, we expect people to access it no later than the beginning of June. If eligible, HMRC will contact you with an online form, they pay the grant straight to your bank account.

831

4/ I’ve taken steps to make the scheme deliverable, and fair.

It’s only open to those with trading profits up to £50,000, who make a majority of their income from self-employment. To minimise fraud only those already in self-employment, who have a tax return for 2019 can apply.

832

6/ To make sure no one who needs it misses out on support, we have decided to allow anyone who missed the filing deadline in January, four weeks from today to submit their tax return.

833

2/ The government will pay self-employed people, who have been adversely affected by the coronavirus, a taxable grant worth 80% of their average monthly profits over the last 3 years, up to £2,500 per month.

Open for at least 3 months across the UK, I will extend if necessary.

834

3/ You’ll be able to claim these grants and continue to do business.

We’re covering the same amount of income as we are for furloughed employees, who also get a grant worth 80%. That’s unlike almost any other country, making our scheme one of the most generous in the world.

835

836

I'm removing some of the exclusions for business rates relief so that retail, leisure, and hospitality properties that have closed as a result of the Covid-19 restriction measures will now be eligible. gov.uk/government/new… #coronavirus

837

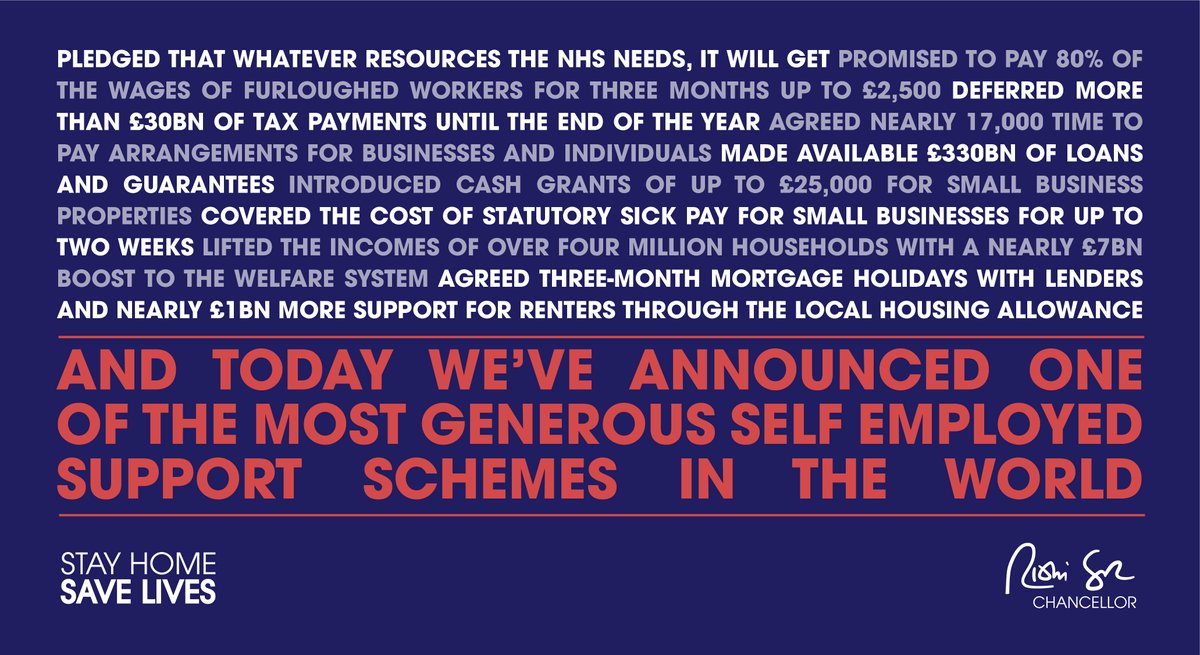

We’ve already announced several measures to help UK businesses and employees during #coronavirus.

To get all the latest information head here: businesssupport.gov.uk/coronavirus-bu…

838

We understand the situation many self-employed people face at the moment and are determined to find a way to support them.

I will be making a further announcement on this in the coming days. #coronavirus

839

We've launched a new website that helps businesses find out how to access the support that has been made available, who is eligible, when the schemes open and how to apply👇 #COVID19

840

The Coronavirus Business Interruption Loan Scheme is now available for small or medium-sized businesses facing cash flow issues.

✅Get loans of up to £5m with 12 months interest free.

british-business-bank.co.uk/ourpartners/co…

841

I've updated my Twitter profile picture to encourage everyone to stay at home and protect our NHS.

You can help spread the word and download your own version here: dropbox.com/sh/yw986o9oy9u… #COVID19

843

Following today’s announcement, new guidance for employees can be found here: gov.uk/government/pub… #COVID19

844

The Government is doing its best to stand behind you – and I am asking you to do your best, to stand behind our workers.

Read my full speech on our plan for people’s jobs and incomes. gov.uk/government/spe…

845

9/ For renters, I’m announcing today nearly £1bn of support by increasing the generosity of housing benefit and Universal Credit, so that the Local Housing Allowance will cover at least 30% of market rents in your area.

846

10/ We want to look back on this time and remember how, in the face of a generation-defining moment, we undertook a collective national effort - and stood together.

It’s on all of us.

847

8/ Taken together, I’m announcing over £6bn of extra support through the welfare system.

And to further support the self-employed through the tax system, I’m announcing today that the next self-assessment payments will be deferred until Jan 2021.

848

7/ I’m also strengthening the safety net for self-employed people by suspending the minimum income floor.

That means self-employed people can now access, in full, Universal Credit at a rate equivalent to Statutory Sick Pay for employees.

849

5/ To help businesses keep people in work, I'm deferring the next quarter of VAT payments.

No business will pay VAT from now to mid June. You'll have until the end of the financial year to repay those bills. That's an over £30bn injection to businesses equivalent to 1.5% of GDP

850

6/ We are already seeing some job losses. Today I’m increasing the Universal Credit standard allowance, for the next 12 months, by £1,000 a year. I’m increasing the Working Tax Credit basic element by the same amount.

These measures will benefit just over 4 million households.