851

💻Help to Grow: Digital is now live!💻

Get a 50% discount on productivity-enhancing software, worth up to £5,000 for your business.

Supercharge your growth 👉 …-to-grow-your-business.service.gov.uk

852

Missed the full speech?

Here are 5️⃣ things you need to know about #Budget2021 and #SpendingReview.

853

🗓️The Job Support Scheme begins on 1 November.

🗒️Guidance for the scheme is available now: gov.uk/guidance/check…

854

855

We’ll continue with the 100% business rates holiday through to the end of June.

For the remaining nine months of the year, business rates will still be discounted by two thirds, up to a value of £2m for closed businesses.

A £6bn tax cut for business. #Budget2021

856

857

We’re providing homeowners and landlords vouchers covering up to two thirds of the cost of green home improvements up to £5,000.

Check your eligibility for a Green Home Grant here: simpleenergyadvice.org.uk/green-homes-gr… twitter.com/SciTechgovuk/s…

858

At #Budget2021 I promised to double the funding to help businesses take on new apprentices.

Today we deliver on that promise and businesses can now claim £3000 for each new apprentice they hire. It’s another important part of our #PlanForJobs.

More: gov.uk/government/new…

859

5/ 95% of people who are majority self-employed will benefit from this scheme.

HMRC are working urgently, we expect people to access it no later than the beginning of June. If eligible, HMRC will contact you with an online form, they pay the grant straight to your bank account.

860

3/ You’ll be able to claim these grants and continue to do business.

We’re covering the same amount of income as we are for furloughed employees, who also get a grant worth 80%. That’s unlike almost any other country, making our scheme one of the most generous in the world.

861

I can confirm today: the planned rise in fuel duty will be cancelled.

That’s a saving over the next five years of nearly £8bn.

After 12 consecutive years of frozen rates, the average car driver has now saved a total of £1,900. #Budget2021

862

You could apply for a Bounce Back Loan in the time it takes to have lunch.

Apply directly with our accredited lenders linktr.ee/rishisunak

863

864

865

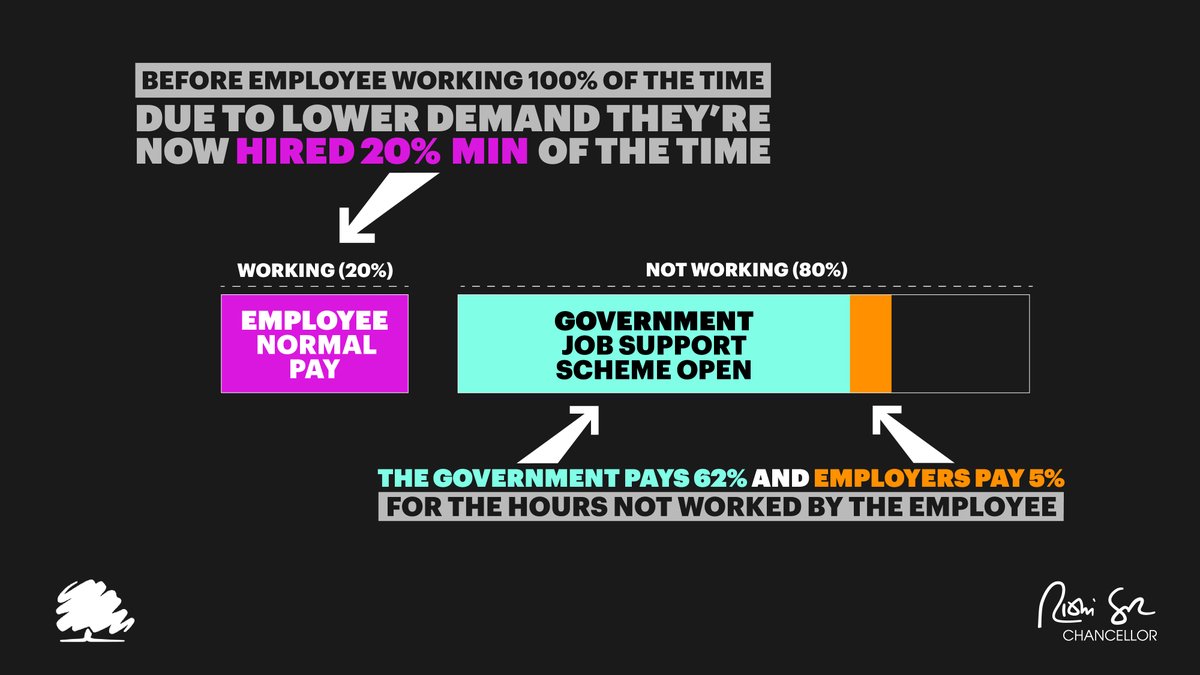

3/ The government, together with employers, will increase those people’s wages 𝐜𝐨𝐯𝐞𝐫𝐢𝐧𝐠 𝟐/𝟑 𝐨𝐟 𝐭𝐡𝐞 𝐩𝐚𝐲 𝐭𝐡𝐞𝐲 𝐡𝐚𝐯𝐞 𝐥𝐨𝐬𝐭 by reducing their working hours.

The employee will keep their job. Anyone who as of yesterday is employed is eligible.

866

867

4/ I’ve taken steps to make the scheme deliverable, and fair.

It’s only open to those with trading profits up to £50,000, who make a majority of their income from self-employment. To minimise fraud only those already in self-employment, who have a tax return for 2019 can apply.

868

2/ The scheme will support viable jobs so 𝐞𝐦𝐩𝐥𝐨𝐲𝐞𝐞𝐬 𝐦𝐮𝐬𝐭 𝐛𝐞 𝐰𝐨𝐫𝐤𝐢𝐧𝐠 𝐚𝐭 𝐥𝐞𝐚𝐬𝐭 𝐚 𝐭𝐡𝐢𝐫𝐝 𝐨𝐟 𝐭𝐡𝐞𝐢𝐫 𝐧𝐨𝐫𝐦𝐚𝐥 𝐡𝐨𝐮𝐫𝐬 and be paid for that work, as normal, by their employer.

869

As the Bounce Back Loan and CBIL schemes come to an end, we’re introducing a new Recovery Loan Scheme to take their place. #Budget2021

870

By age thirty, people with poor numeracy skills are more than twice as likely to be unemployed as their peers.

So today we launch: Multiply.

Multiply is a £560m, three-year plan to improve basic maths skills and change people’s lives across the whole United Kingdom. #Budget2021

871

872

873

874

875

Help to Grow: Management will help thousands of SMEs get world-class management training.

Help to Grow: Digital will help them develop digital skills with free expert training and a 50% discount on new productivity-enhancing software

Register now: gov.uk/helptogrow